Fintechzoom.com European Stock Markets Plunge 8.81% in April 2025: Key Factors and Future Outlook

Meta Title

Fintechzoom.com European Stock Markets Plunge 8.81% in April 2025: Causes and Investor Implications

Meta Description

Discover why European stock markets have declined sharply in April 2025 and what this means for your investments. Get expert analysis and insights here.

As of April 18, 2025, the STOXX Europe 600 index, a key barometer of European stock market performance, has experienced a significant decline of 8.81% for the month. This downturn has sent ripples through the financial world, prompting investors and analysts to scrutinise the underlying causes and potential implications for the future.

In this comprehensive blog post, we delve into the factors driving this decline, examine the performance of major European indices, and provide insights into what this means for investors and the broader economic landscape. Whether you’re a seasoned investor or just starting out, understanding these dynamics can help you navigate these turbulent times and potentially capitalise on future opportunities.

Understanding the STOXX Europe 600 Index

The STOXX Europe 600 is a stock market index that tracks the performance of 600 large, mid, and small-cap companies across 17 European countries. It is widely regarded as a benchmark for the European equity market, representing approximately 90% of the free-float market capitalisation across these nations.

Comprising companies from sectors such as finance, industry, healthcare, and consumer goods, the STOXX Europe 600 provides a broad view of the European economy’s health. Its performance is closely watched by investors, policymakers, and economists alike, as it reflects the overall sentiment and trends in the region’s stock markets.

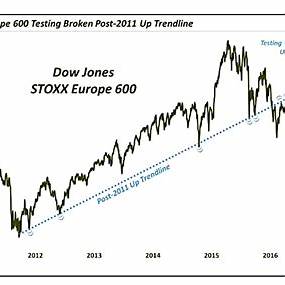

Image placeholder: STOXX Europe 600 composition chart

Alt text: Composition of STOXX Europe 600 index

For more details on the index, visit the official STOXX Europe 600 page.

Factors Behind the April 2025 Decline

The primary driver behind the recent plunge in European stock markets is the escalation of trade tensions between the United States and its trading partners, particularly China. U.S. President Donald Trump’s decision to impose sweeping tariffs on imports has created uncertainty and fear of a global trade war, leading to a sell-off in stock markets worldwide.

These tariffs have significantly impacted European companies that rely heavily on exports to the U.S. or have substantial operations there. For example:

- Luxury goods companies like LVMH have seen stock price declines due to potential tariffs on high-end products, which could reduce demand in the U.S. market.

- Automotive manufacturers are facing increased costs and supply chain disruptions, as tariffs raise the price of components and finished vehicles.

Moreover, the European Central Bank’s (ECB) recent monetary policy actions have contributed to the market’s downturn. The ECB’s decision to cut interest rates, as reported by Reuters, signals concerns about economic growth and has further weighed on investor sentiment.

Other contributing factors include global economic uncertainties and sector-specific challenges. For instance, technology firms are grappling with supply chain issues, while energy companies are affected by fluctuating oil prices, as noted in a CNBC report.

To understand the broader context of these trade tensions, read more in this Euronews article.

Performance of Major European Indices

As of April 17, 2025, the major European stock indices showed the following performances, according to data from Bloomberg:

| Index | Value | Daily Change | % Change | 1-Month Change | 1-Year Change |

|---|---|---|---|---|---|

| Euro Stoxx 50 | 4,935.34 | -31.16 | -0.63% | -9.01% | -0.03% |

| DAX (Germany) | 21,205.86 | -105.16 | -0.49% | -7.36% | +18.73% |

| CAC 40 (France) | 7,285.86 | -44.11 | -0.60% | -9.41% | -9.38% |

| FTSE 100 (UK) | 8,275.66 | +0.06 | +0.00% | -4.29% | +3.14% |

| IBEX 35 (Spain) | 12,918.00 | -24.10 | -0.19% | -3.24% | +18.62% |

These figures indicate a generally negative trend across most major markets, with the FTSE 100 being the exception, remaining flat. The STOXX Europe 600, as reported by TradingEconomics, stood at 506.42 points on April 18, 2025, with a month-to-date decline of 8.81%.

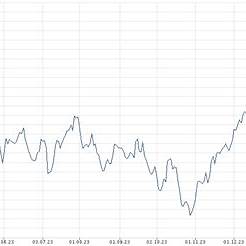

Image placeholder: STOXX Europe 600 performance chart

Alt text: STOXX Europe 600 performance in April 2025

Case Study: Impact on Key Sectors

To illustrate the real-world impact of these market dynamics, consider the luxury goods and automotive sectors:

- Luxury Goods: Companies like LVMH have faced challenges due to potential U.S. tariffs on high-end products. As reported by Reuters, LVMH’s CEO expressed concerns about trade tensions, highlighting the sector’s vulnerability to policy changes.

- Automotive: European carmakers, such as Volkswagen and BMW, are dealing with higher production costs and supply chain disruptions. The threat of tariffs has led to a reevaluation of investment plans and pricing strategies, impacting stock valuations.

These examples underscore the broader economic implications of trade policies and the need for investors to monitor sector-specific developments.

Key Points

- The European stock markets, as tracked by the STOXX Europe 600 index, likely experienced a significant decline of 8.81% in April 2025, based on data up to April 18, 2025.

- U.S. tariffs and trade tensions appear to be the primary drivers, causing uncertainty and impacting sectors like automotive and luxury goods.

- Investors may face challenges but could find opportunities by diversifying and focusing on resilient companies.

- The future outlook depends on trade negotiations and economic policies, with volatility expected in the short term.

What’s Happening in European Markets?

As of April 18, 2025, the STOXX Europe 600 index, which tracks 600 companies across 17 European countries, has dropped by 8.81% this month. This decline reflects broader market concerns, primarily driven by U.S. tariffs imposed on imports, which have sparked fears of a global trade war. These tariffs have hit European companies hard, especially those in sectors like automotive and luxury goods that rely on exports to the U.S.

Why Are Markets Declining?

The main reason for the market drop seems to be the trade policies introduced by U.S. President Donald Trump. These policies have increased costs for European businesses and created uncertainty about future trade relations. Additionally, the European Central Bank’s recent rate cuts suggest worries about economic growth, which may be adding to investor caution.

What Should Investors Do?

For people investing in European markets, this decline might feel unsettling, but it could also present opportunities. Spreading investments across different industries and regions can help reduce risk. Looking for companies with strong finances and stable operations might be a smart move. Staying updated on trade news and economic reports can also guide better decisions.

What’s Next for European Markets?

The future of European markets likely hinges on whether trade tensions ease. If the U.S. and other countries reach trade agreements, markets could recover. However, if tariffs continue or worsen, further declines are possible. Central banks might step in with more support, but short-term ups and downs are expected.

What This Means for Investors

The recent decline in European stock markets presents both challenges and opportunities for investors. The volatility and uncertainty created by trade tensions can lead to short-term losses and increased risk. However, market downturns often create buying opportunities for long-term investors who believe in the fundamental strength of European companies.

Here are some actionable strategies for investors:

- Diversify Investments: Spread investments across different sectors (e.g., healthcare, technology) and geographies to mitigate risk.

- Focus on Resilient Companies: Look for firms with strong balance sheets, consistent cash flows, and business models that can withstand economic headwinds.

- Stay Informed: Monitor policy developments, trade negotiations, and corporate earnings reports to make informed decisions.

For instance, investors might consider companies like Maersk, a global shipping giant that saw gains after a temporary tariff pause, as noted in a CNBC article. Such companies may offer stability in volatile markets.

For more guidance on navigating market volatility, explore this FintechZoom article: How to Invest During Market Volatility.

Future Outlook and Predictions

The future trajectory of European stock markets will largely depend on the resolution of trade tensions and the global economic outlook. Several scenarios are possible:

- Positive Outcome: If the U.S. and China reach a trade agreement or if tariffs are rolled back, investor confidence could return, leading to a rebound in stock prices. The temporary tariff pause on April 10, 2025, which sparked a 3.7% rally in the STOXX 600, as reported by Reuters, suggests markets are sensitive to positive trade developments.

- Negative Outcome: If trade wars escalate or the global economy slows significantly, further declines could occur. The Bank of England’s warning about intensified global risks, as noted in a CNBC report, highlights the potential for further market corrections.

- Central Bank Actions: The ECB and other central banks may implement additional stimulus measures, such as further rate cuts or quantitative easing, to support economic growth. These actions could stabilize markets but may also signal ongoing economic concerns.

In the short term, market volatility is likely to persist as investors react to news and adjust their portfolios. Long-term investors, however, may find opportunities to buy quality stocks at discounted prices, particularly in sectors with strong fundamentals.

For a deeper dive into future market trends, read FintechZoom’s analysis: Market Predictions for 2025.

Key Citations

- Bloomberg: European, Middle Eastern & African Stocks

- TradingEconomics: Euro Area Stock Market Index (EU50)

- Euronews: European markets dive as global tariff fears shake investor confidence

- STOXX: STOXX Europe 600 Index

- Reuters: European shares notch best day in over three years after Trump’s tariff pause

- CNBC: European markets: stocks, news, data and earnings (April 11, 2025)

- CNBC: European markets: Trump tariff u-turn shocks the world

- CNBC: European markets: stocks, news, data and earnings (April 9, 2025)

- Reuters: European Market Headlines | Breaking Stock Market News

Conclusion

The 8.81% decline in the STOXX Europe 600 index in April 2025 serves as a stark reminder of the impact geopolitical events can have on financial markets. While the short-term outlook remains uncertain, history shows that markets are resilient and can recover from such downturns.

Investors should remain vigilant, stay informed, and adapt their strategies to the current environment. By diversifying portfolios, focusing on resilient companies, and monitoring global developments, investors can navigate these turbulent times and potentially capitalize on future opportunities.

For more insights and analysis on global markets, stay tuned to FintechZoom.com.

you may also like;

FintechZoom.com Crypto Mining: Everything You Need to Know in 2025

FintechZoom Top STOXX Gainers Today: 5 Powerful Stocks to Watch

Fintechzoom.com 8 Must-Know Features of the Best Air Purifiers in 2025: Your Guide to Cleaner Air – crypto mining for beginners

[…] Fintechzoom.com European Stock Markets Plunge 8.81% in April 2025: Key Factors and Future Outlook […]

7 Proven Steps to Find the Best Crypto Accountant Near Me in 2025 – crypto mining for beginners

[…] more in our [7 Essential Tips to Find the Best Bitcoin Tax Specialist in 2025 for Crypto Investors Fintechzoom.com European Stock Markets Plunge 8.81% in April 2025: Key Factors and Future Outlook FintechZoom.com Crypto Mining: Everything You Need to Know in 2025 […]

Fintechzoom.com Student Credit Card 2025: 7 Ultimate Tips – crypto mining for beginners

[…] Fintechzoom.com European Stock Markets Plunge 8.81% in April 2025: Key Factors and Future Outlook […]

5 Shocking Truths About No Tax on XRP: What US Investors Need to Know in 2025 – crypto mining for beginners

[…] Internal Link: Check our [Crypto Tax Planning Guide 7 Essential Tips to Find the Best Bitcoin Tax Specialist in 2025 for Crypto Investors Fintechzoom.com European Stock Markets Plunge 8.81% in April 2025]. […]

FintechZoom.com Crypto Mining: Everything You Need to Know in 2025 – crypto mining for beginners

[…] on logistics, and avoid the clickbait traps you see on shadier sites. I’ve cross-checked their Bitcoin price reports with CoinMarketCap, and they’re spot-on. That said, always double-check their sources yourself; I once noticed they […]

Unveiling 5 Powerful Secrets of FintechZoom.com CAC 40: Your Ultimate Guide to Investing in 2025 – crypto mining for beginners

[…] By May 2025, his investment grew to $10,500—a 5% gain. He loves the low fees and broad exposure. A CAC 40 index ETF is a low-risk way to enter European […]

Master the 1040 Digital Asset Question in 2025: A US Taxpayer’s Guide – crypto mining for beginners

[…] may also like: Fintechzoom.com European Stock Markets Plunge 8.81% in April 2025: Key Factors and Future Outlook Top Lawyers Specialising in Cryptocurrency Recovery in 2025 7 Surprising Facts About XRP Tax Exempt […]

7 Shocking Truths About the Wash Sale Rule and Crypto: Your 2025 Guide to Tax-Smart Investing – crypto mining for beginners

[…] may also like: Fintechzoom.com European Stock Markets Plunge 8.81% in April 2025: Key Factors and Future Outlook Top Lawyers Specialising in Cryptocurrency Recovery in 2025 7 Surprising Facts About XRP Tax Exempt […]

7 Crucial Facts About Is USDC Taxable in 2025 for US Investors – crypto mining for beginners

[…] may also like: Fintechzoom.com European Stock Markets Plunge 8.81% in April 2025: Key Factors and Future Outlook Top Lawyers Specialising in Cryptocurrency Recovery in 2025 7 Surprising Facts About XRP Tax Exempt […]

7 Proven Strategies to Tackle Unsellable NFTs in 2025: Turn Your Digital Assets into Cash – crypto mining for beginners

[…] may also like: Fintechzoom.com European Stock Markets Plunge 8.81% in April 2025: Key Factors and Future Outlook Top Lawyers Specialising in Cryptocurrency Recovery in 2025 7 Surprising Facts About XRP Tax Exempt […]

Mining Rig vs. Cloud Mining in 2025: Which One Should You Choose? – crypto mining for beginners

[…] may also like: Fintechzoom.com European Stock Markets Plunge 8.81% in April 2025: Key Factors and Future Outlook Top Lawyers Specialising in Cryptocurrency Recovery in 2025 7 Surprising Facts About XRP Tax Exempt […]

5 Unfiltered AI Chatbot for Users – crypto mining for beginners

[…] may also like: Fintechzoom.com European Stock Markets Plunge 8.81% in April 2025: Key Factors and Future Outlook Top Lawyers Specialising in Cryptocurrency Recovery in 2025 7 Surprising Facts About XRP Tax […]

Can You Finance Through Auto Bid Master? The 2025 Reality – crypto mining for beginners

[…] may also like: Fintechzoom.com European Stock Markets Plunge 8.81% in April 2025: Key Factors and Future Outlook Top Lawyers Specialising in Cryptocurrency Recovery in 2025 7 Surprising Facts About XRP Tax […]

Breaking 2025 News: US Banks Get Green Light for Crypto Custody—What It Means for Finance – crypto mining for beginners

[…] may also like: Fintechzoom.com European Stock Markets Plunge 8.81% in April 2025: Key Factors and Future Outlook Top Lawyers Specialising in Cryptocurrency Recovery in 2025 7 Surprising Facts About XRP Tax […]

Donald Trump's Crypto Holdings Now Constitute Nearly 40% of His Net Worth – crypto mining for beginners

[…] may also like: Fintechzoom.com European Stock Markets Plunge 8.81% in April 2025: Key Factors and Future Outlook Top Lawyers Specialising in Cryptocurrency Recovery in 2025 7 Surprising Facts About XRP Tax […]

Breaking 2025 News: New Hampshire Pioneers First State-Level Cryptocurrency Reserve in the US – crypto mining for beginners

[…] may also like: Fintechzoom.com European Stock Markets Plunge 8.81% in April 2025: Key Factors and Future Outlook Top Lawyers Specialising in Cryptocurrency Recovery in 2025 7 Surprising Facts About XRP Tax […]